Last updated July 21, 2025

The Act was signed into law on January 5, 2025.

The Act ends the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO). These provisions reduced or eliminated the Social Security benefits of over 2.8 million people who receive a pension based on work that was not covered by Social Security (a “non-covered pension”) because they did not pay Social Security taxes. This law increases Social Security benefits for certain types of workers, including some:

- teachers, firefighters, and police officers in many states;

- federal employees covered by the Civil Service Retirement System; and

- people whose work had been covered by a foreign social security system.

Learn more below about the steps the Social Security Administration (SSA) is taking to implement the law.

Not necessarily. We know that some press articles have mentioned teachers, firefighters, police officers, and other public employees when discussing the new law. However, only people who receive a pension based on work not covered by Social Security may see benefit increases. Most state and local public employees – about 72 percent – work in Social Security-covered employment where they pay Social Security taxes and are not affected by WEP or GPO. Those individuals will not receive a benefit increase due to the new law.

Starting February 25, 2025: SSA began adjusting monthly benefit payments to people whose benefits have been affected by the WEP and GPO.

If a beneficiary is due additional benefits as a result of the Act, they will receive a one-time payment, deposited into the bank account SSA has on file. This payment will cover the increase in their benefit amount back to January 2024, the month when WEP and GPO no longer applies.

Social Security benefits are paid one month behind. Most affected beneficiaries began receiving their new monthly benefit amount in April 2025 (for their March 2025 benefit).

As of July 7, 2025, we completed sending over 3.1 million payments, totaling $17 billion, to beneficiaries eligible under the Social Security Fairness Act, 5 months ahead of schedule.

Anyone whose monthly benefit is adjusted, or who will get a past due payment, will receive a mailed notice from Social Security explaining the benefit change or past due payment.

NOTE: A beneficiary may receive two mailed notices, the first when WEP or GPO is removed from their record, and a second when their monthly benefit amount is adjusted for their new monthly payment amount. They may receive the past due payment before receiving the mailed notice.

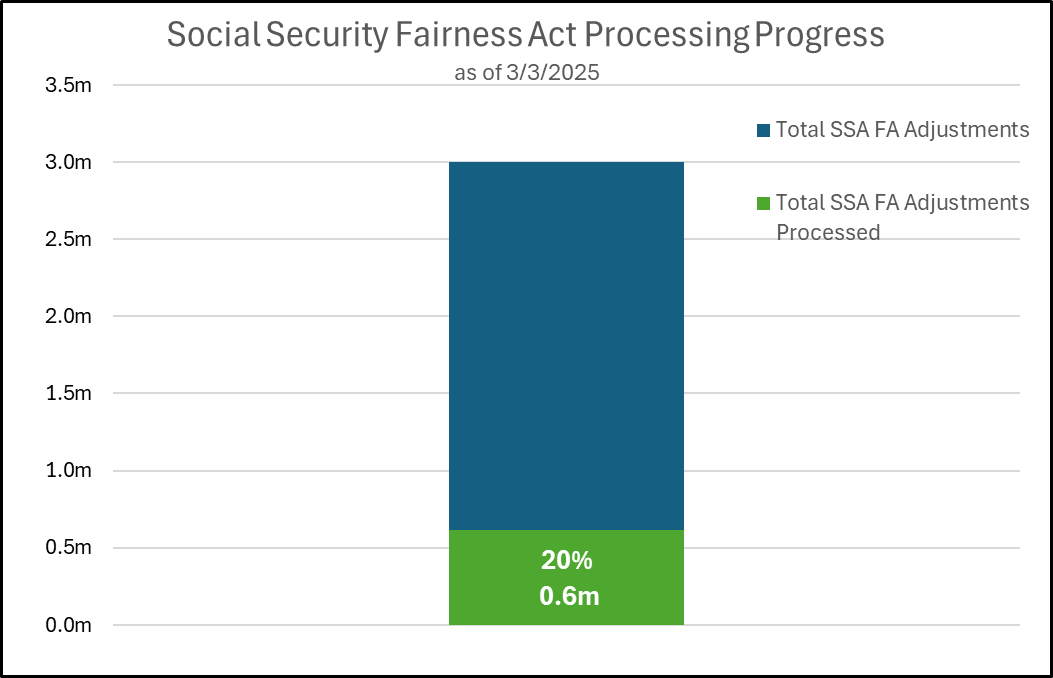

The chart below shows SSA’s progress with processing adjustments from February 25, 2025 through July 4, 2025.

You can view the amount we’ve paid through the automation runs by state and zip code.

The amount monthly benefits may change can vary greatly. Depending on factors such as the type of Social Security benefit received and the amount of the person’s pension, some people’s benefits will increase very little while others may be eligible for over $1,000 more each month.

December 2023 is the last month that WEP and GPO will apply. This means that those rules no longer apply to benefits payable for January 2024 and later. Important reminder: Social Security benefits payable for January 2024 would generally have been received in February 2024.

The Act applies to benefits you get on your own record (retirement or disability benefits) and to spouse’s or surviving spouse’s benefits on another person’s record. What action you need to take depends on your situation and on what type of benefits you are eligible for.

If you are entitled to retired or disabled workers’ benefits, and your benefits are currently being reduced by WEP; OR if you are entitled to spouse’s or surviving spouse’s benefits, and your benefits are currently being reduced or eliminated by GPO:

- If you know that SSA has your mailing address and direct deposit information on file, no other actions are needed from you at this time.

- If you want to verify that the mailing address and direct deposit information that SSA has on file is accurate and up to date:

- Check your personal my Social Security account. Visit www.ssa.gov/my account to sign in or create an account.

- If you are unable to create an account, please call 1-800-772-1213 to verify the information we have on file.

Ensuring that SSA has the correct information allows you to get any past due benefits and your new benefit amount quicker.

If you are not sure whether you ever applied for retirement, spouse’s, or surviving spouse’s benefits:

- You may need to file an application. The date of your application might affect when your benefits begin.

If you never applied for retirement due to WEP or spouse’s or surviving spouse’s benefits because of GPO:

- You may need to file an application. The date of your application might affect when your benefits begin and your benefit amount. However, each case is different, and all other Social Security laws and policies, such as benefit reductions for claiming benefits before the full retirement age, the retirement earnings test, and others, still apply.

Retirement or Spouse’s Benefits

- The most convenient way to apply for retirement or spouse’s benefits is online at www.ssa.gov/apply.

- If you are applying for spouse’s benefits, please note that selecting “Family Benefits” will take you to the application for Retirement/Medicare benefits. This process ensures that you will be considered for all benefits you are entitled to.

- We can take an application by telephone for people who did not previously apply for retirement benefits because of WEP or spouse’s benefits because of GPO. If you meet these conditions, call 1-800-772-1213 Monday through Friday, from 8:00 a.m. to 7:00 p.m. local time.

Surviving Spouse’s Benefits:

- The survivor benefit application is not available online.

- Call 1-800-772-1213 Monday through Friday, from 8:00 a.m. to 7:00 p.m. local time.

- For additional eligibility information, visit www.ssa.gov/apply.

As of week, ending July 17, 2025, SSA has taken 289,715 new applications since the Social Security Fairness Act was passed. We have completed 92% of the new applications.

SSA recommends that, until they get a notice from SSA, the person should continue to follow the instructions on the Medicare premium bill and pay the bill to ensure their Medicare coverage does not stop. SSA will send a notice telling people when their Social Security record is updated. Once the person begins receiving a Social Security benefit, the Medicare premium will be deducted from their monthly payment. If the benefit is not enough to cover the Medicare premium, the person will be billed for the remainder. SSA's notice will include this information.

If the person prepaid their premiums to the Centers for Medicare & Medicaid Services, and SSA tells them that their premiums will now be deducted from their monthly Social Security benefits, they will receive any applicable refund. SSA's notice will include this information.

You may need to take action. For people who pay their Medicare premium using Automated Clearing House (ACH), also known as Medicare Easy Pay or Online Bill Payment: Once SSA notifies the person that they will receive a benefit increase, the Medicare premium will automatically be deducted from their monthly Social Security payment.

-

For people using Medicare Easy Pay: They should arrange to stop the ACH payments by completing the Authorization Agreement for Preauthorized Payments form (SF-5510) and sending to the address on the form or online at Medicare.gov. Both options are located at https://www.medicare.gov/basics/costs/pay-premiums/medicare-easy-pay.

-

For people using Online Bill Payment: If a person is paying their Medicare premiums through their bank's online bill payment service, they should contact their bank to stop their online bill payments.

Call 1-800-MEDICARE (1-800-633-4227) for assistance.

If a person has had their premiums deducted from their CSRS annuity, and then applies for Social Security benefits, SSA will tell the person that their premiums will now be deducted from their monthly Social Security benefits. SSA's notice will include this information. In most cases, the premium refund will be included in the back payment from SSA. If not, the refund will be issued at the end of the calendar quarter. If you do not receive a premium refund within 6 weeks of the close of the calendar quarter, please contact SSA. Please contact SSA if you have any questions about your premiums.

The Centers for Medicare & Medicaid Services (CMS) is working on this issue. Anyone who had too many Medicare premiums withheld will receive a refund. You do not need to call, but if you have questions on this specific issue, contact 1-800-MEDICARE (1-800-633-4227).

WEP and GPO still apply to months prior to January 2024. some instances, we may need to request the amount received for your pension from work not covered by Social Security to verify we are paying you correctly for these months. You do not need to contact us to report changes if this applies to you. If we need updated pension information, we will send a request for information to you.

Unfortunately, bad actors might attempt to take advantage of situations when money is involved. SSA will never ask or require a person to pay either for assistance or to have their benefits started, increased, or paid. Hang up and do not click or respond to anyone offering to increase or expedite benefits. Learn more about Social Security-related scams, and how to report them to SSA's Office of the Inspector General, at www.ssa.gov/scams.

SSA has taken several steps to tell people what it is doing to implement the Act and to provide important updates to avoid unnecessary calls or visits while we finalize the implementation plan. SSA:

- Created this Social Security Fairness Act webpage to explain what the Act does, what steps—if any—someone should take, and other helpful information. The webpage offers the option to subscribe to receive alerts when SSA updates the webpage, eliminating the need to return to the webpage to check for updates. SSA encourages media and third-party groups to direct people to this webpage for information.

- Added upfront messaging to its National 800 Number about the Act so callers do not need to wait to speak to a representative.

- Plans informational meetings with state retirement boards, labor unions, financial planners, human resources professionals, and the advocate community.

As of July 7, 2025, SSA completed sending over 3.1 million payments, totaling $17 billion, to beneficiaries eligible under the Social Security Fairness Act, 5 months ahead of schedule. SSA announced this significant milestone in a Press Release and Blog Post. SSA will continue to update this webpage, as needed, to further help people affected by the Act.

If you were already receiving benefits that were affected by WEP or GPO, the last month WEP or GPO applied was December 2023. Any payment adjustments due would begin for benefits payable starting in January 2024 (paid in February 2024). To receive increased payments for those months, you had to have been entitled to benefits that were either fully or partially reduced by WEP or GPO for those months.

If you were not receiving benefits that were affected by WEP or GPO because you did not previously apply for those benefits, then you will need to contact us to file an application for benefits. The Social Security Fairness Act did not change the provisions of the Social Security Act that govern the retroactivity of benefit applications. Retroactivity for some retirement and survivor’s benefits is generally limited to six months before the month in which the benefit application is filed, although some claims based on disability may be entitled to 12 months of retroactive benefits.

Those rules remain unchanged. Since the Social Security Fairness Act was signed, we have consistently encouraged people who had never applied or were not sure if they applied to consider applying for benefits because the date of your application might affect when your benefits begin.